Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

We explain the core concepts of Fizzswap's smart contract structure, swap requests, and providing liquidity.

Welcome to the Fizzswap documentation!

In this documentation, we introduce Fizzswap, the AMM protocol for the Silicon Network.

Fizzswap is a comprehensive DeFi protocol built on the Silicon chain, an Ethereum Layer 2 solution. As an Automated Market Maker (AMM) Decentralized Exchange (DEX), Fizzswap allows anyone to participate in the protocol and earn pool fees and various rewards.

Fizzswap supports the exchange of multiple tokens through optimal swap paths, a core feature of DEXs. Additionally, it offers a variety of services such as concentrated liquidity pool participation and token borrowing based on a single liquidity pool(supplying).

Beyond simple asset swaps, Fizzswap aims to lead the growth of the Fizzswap and Silicon ecosystems by providing users with new liquidity participation opportunities to access innovative and unique tokens quickly and freely.

Fizzswap has the following advantages.

Anticipation and demand for new tokens naturally stimulate trading activity. Based on increased trading volume, Liquidity Providers (LPs) can earn attractive pool usage fees.

As liquidity deepens and trading volume increases, liquidity providers receive more pool usage fees as rewards, leading to the sustainable growth of the Fizzswap ecosystem and community.

Fizzswap is a DEX operating on the Silicon Network, a zero-knowledge rollup scaling solution built using Polygon's Chain Development Kit (CDK) and Aggregation Layer (Agg Layer) technology. It enables users to provide liquidity not only for Silicon native tokens but also for tokens from Ethereum and other networks.

By leveraging assets from various networks, Fizzswap enhances interoperability with other DApps and expands its ecosystem.

Additionally, it offers a superior trading experience with faster transaction processing speeds, lower transaction fees (gas fees), and the maintained security of the mainnet.

Fizzswap is having a security audit conducted by globally renowned security audit agencies. The Fizzswap protocol consists of and operates through a variety of smart contracts. A single, small vulnerability within a smart contract can lead to devastating accidents related to service availability and security. Fizzswap puts the safety of its users' transactions first, and is in the process of getting a security certification with ResearchLab and ChainLight to assure safe protection against any possible security incidents in the near future.

This Privacy Policy explains the way of treatment on the Fizzswap.com website (the “Service”) of the user information for the Service.

The Service does NOT collect, use users' personal information or provide it to the third parties.

* The Services does NOT request, store, or process information that can identify users individually, or information such as private key, mnemonic key, and seed phrase required to access the user's wallet, or information equivalent thereto. Therefore, users must manage the above information safely by themselves, and the service is not responsible for any damage caused by the user's failure to fulfill this duty of care.

1. The Service may use 'cookies' that store and retrieve use of information from time to time to provide users with individually customized services.

2. Cookies are very small text files to be sent to the browser of the users by the server(http) used for the operation of the websites of the company and may be stored on hard disks of the users' computer (PC).

1) Purpose of using cookies: Cookies are used to provide optimized information to users by identifying the types of visits and usage of each service and website visited by the user, popular search terms, and whether or not secure access is available.

2) Installation, operation, and rejection of cookies: A user can enable or disable cookie storage using the basic function of a web browser. For detailed cookie setting methods for each browser, please refer to the description of each browser.

3) If a user refuses to provide cookies, a user may experience difficulties in using customized services.

The Service uses the behavioral information analysis service using the following external analysis tools for service quality improvement, statistical purpose, and research. If a user would like to be excluded from this analysis, such user can turn it off by following the instructions in each item.

1) Google LLC, () (USA)

- Collection method: Transmission through the network at the time of the visitor’s using the Service within the website

- Collected items: Cookies, device browser-related data, device information, site activity information

- How to unset:

If you have any questions about this Privacy Policy, please contact [email protected] The user's message is forwarded to the person in charge of the company's privacy policy.

The Service may revise and post this Privacy Policy from time to time, and the revised policy will take effect from the same time as it is posted. If the privacy policy is changed significantly unfavorable to users, it will be posted at least 30 days before the effective date.

1. Click [Manage] of the pool you wish to remove liquidity from on the V3 pool list page.

2. Click the [Remove] tab on the V3 pool detail page and drag the slider or click a button to select the amount (%) to remove.

3. When removeing from "You Get", click on [Remove] after checking the tokens and pool usage fee rewards that you will be receiving.

4. Click [Remove] once you have checked the estimated information on the "Confirm Transaction" pop-up. Click the [Confirm] button in your wallet once you have confirmed the information.

Users can deposit assets in any type of pools they favor, and we call these ecosystem participants Liquidity Providers (LP). Providing liquidity to the pool will result in the receipt of Liquidity Pool (LP) Token as evidence, and the number of LP Token received represents my share(%) in the entire pool.

If you remove all your assets from the pool, the LP Token will be automatically returned, and the user can receive the following rewards from the pool through the proof of LP Token during the asset supply period.

1) To remove assets, users must have LP NFT assets corresponding to the supply certificate in their wallets, and the NFT asset approval transaction must be completed. Transaction fees are incurred on the Klaytn chain when a transaction is executed. The wallet owner has the right to transfer LP NFT assets, so if the asset is transferred to another wallet, removal is not possible.

2) During the removal process, the difference between the price at the time of supply and removal may result in asset loss.

3) Due to balance changes at the time of removal, asset composition ratios and values are subject to change (see detailed policy on V3 Supply below), and all rewards (pool usage fee rewards, airdrop tokens, etc.) distributed up to that point will be automatically credited to user’s wallet.

4) Removals proceed only within the transaction range (slippage) set at the time of removal, and if the range is exceeded, the removal may not proceed. Proceed with removal after reviewing all related information in the estimated details section below.

Pool usage fee rewards If the user supplies liquidity to the general pool, users can receive the transaction fee according to their LP stake(%) in the pool. Pool usage fees are accumulated in the pool and, in case of removal, the total amount removal includes pool usage fee rewards, and the process depends on the exchange ratio at the time of removal. (80% of the pool usage fee incurred)

Contract Address: 0x3a3f0074f29147769ac856e0d980165495933ccc

Chain: Silicon

Total Supply: 100,000,000

Token Allocation

Reserve (85%): This portion of the tokens will be allocated to various purposes such as community, initial airdrop, liquidity, and marketing to establish an effective tokenomics model. The specific allocation and percentages will be finalized and announced in the first half of 2025 when the Silicon network becomes fully operational.

Dev (15%): This portion is allocated for the maintenance and development of the protocol and frontend.

Please refer to the V3 pool Supply & Removal guide and policy.

Unlike the V2 pool, which supplies assets in all price ranges (0~∞), the V3 Pool supplies assets in a specific price range. Concentrated liquidity refers to a supply of assets in a particular range, and liquidity can only be utilized within that range. Fizzswap's primary driving force is the expansion of liquidity pools. As more assets (liquidity) are supplied into liquidity pools, more transactions occur, and as more pool usage fees are distributed to liquidity providers, more liquidity and suppliers will join the Fizzswap ecosystem.

However, the existing V2 pool was built with a CPMM model (Uniswap V2) based on x ∗ y = k, which supplies assets in all price ranges. This leads to a problem of 'low liquidity efficiency', where most supplied liquidity is not utilized for trading. As a result, Fizzswap's overall trading volume and pool usage fee profit ends up declining, weakening the users' motivation to provide additional liquidity.

The V3 Pool provides liquidity at a price level where transactions frequently occur so that the created liquidity can be used for a broader range of transactions. Making a considerable fee profit will increase rewards for Fizzswap ecosystem participants to be carried out more efficiently.

The following are the key features of Fizzswap's V3 pool.

V3 pool suppliers will receive 80% of the fee profit generated in the pool. The assets supplied in V3 pools are actively used for transactions, making it possible for suppliers to generate more profit.

By distributing these pool usage fee profits to suppliers, suppliers can reduce their chance of impermanent losses in liquidity supply.

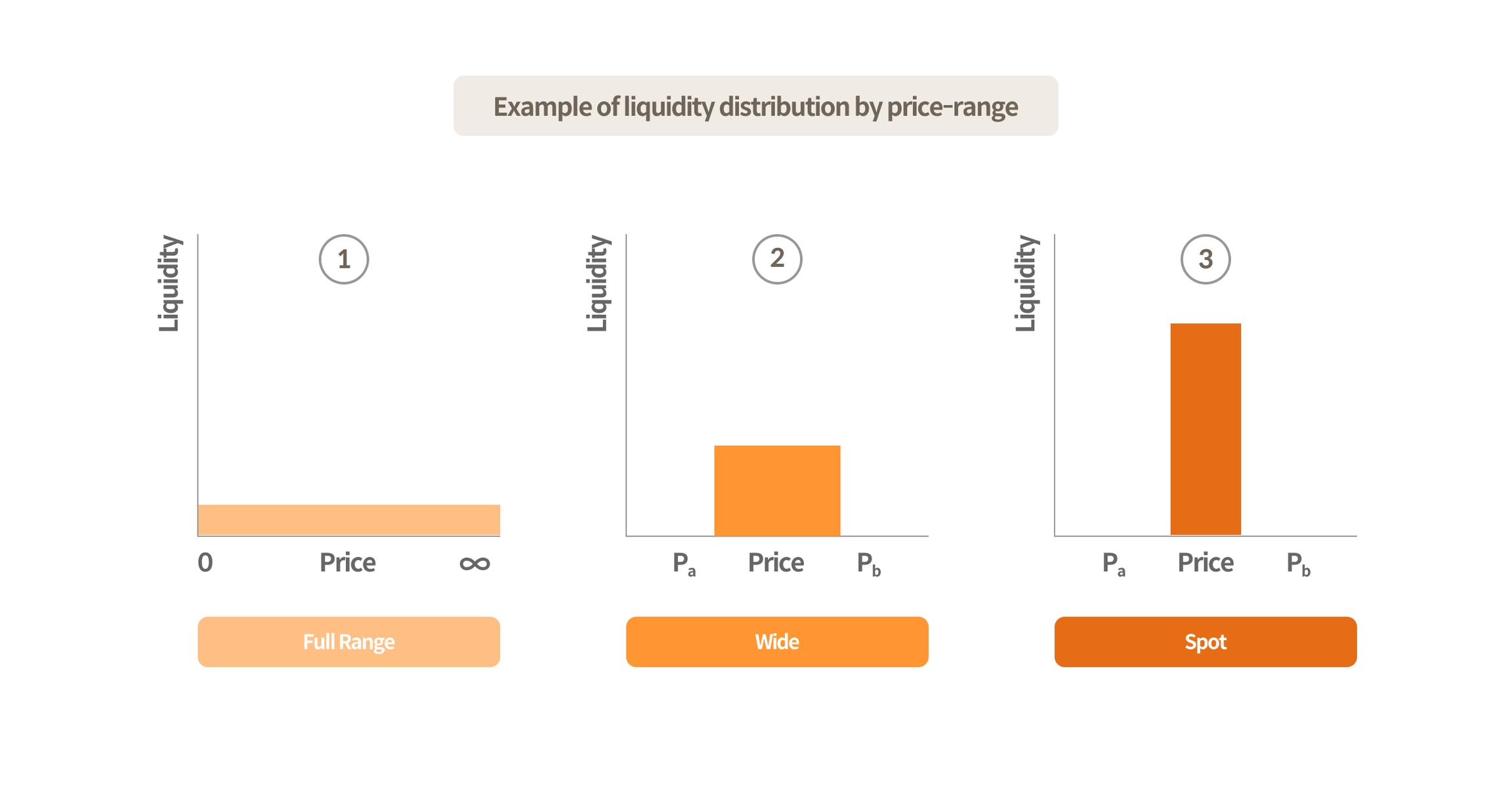

Users can customize the price range for supplies. Users can also supply quickly and conveniently by choosing one of the three price ranges (Spot, Wide, Full range) provided by Fizzswap V3 pool. Price ranges of each type range from +n% to -n%, according to a parameter previously set by a contract.

A ‘price range’ represents the range of prices within which supplied assets can be traded, and when a transaction is conducted within that range, suppliers will receive their pool usage fees. Each price range has the following characteristics.

Characteristics of Spot, Wide, and Full price ranges

Suppliers can expect a higher pool usage fee profit if the price range is narrower, as the liquidity provided by users are more likely to be used for transactions.

However, since tokens with large price fluctuations are supplied intensively in a narrow price range, it is necessary to continuously monitor the current token price to ensure that it stays within the supplied range. In such a case, the assets should be migrated to valid price ranges where the swap occurs. Furthermore, the more suppliers provide within a narrower price range, the more likely the token's price will change from the time of supply, causing the impermanent loss to increase(Please refer to.)

Using the above method, Fizzswap V3 pool offers suppliers with no previous experience in providing V3 liquidity the convenience and flexibility to do so. Future updates will enable suppliers to customize their price range.

The Fizzswap V3 pool offers one-stop migration, allowing suppliers to migrate their assets with a single transaction. The detailed procedure consists of asset removal - supply in a new price range, and suppliers can migrate from the details page of the pool they provided liquidity for.

V3 pool aims to make the flow of liquidity capital within the ecosystem more efficient and dynamic. V3 pools will offer a more favorable trading environment, thereby enabling Fizzswap to secure a higher trading volume.

The V3 pool distributes 80% of the pool usage fee profit to V3 pool suppliers in order to continuously fill the pool with new liquidity. As a result of such a process, Fizzswap's TVL rises, creating a virtuous cycle, which ensures abundant liquidity, and generates more profit from pool usage fees based on that high TVL.

024-07-17

ChainLight@Theori

All Contract

2024-05-03

78ResearchLab

All Contract

To use Fizzswap, you must first create your crypto wallet. In the DeFi protocol, a personal crypto wallet is your account. You can make transactions using cryptocurrency such as supplies, removals, and swaps by connecting your wallet to Fizzswap.

Before you start using Fizzswap, you must set up a personal wallet. In the DeFi protocols, wallets serve as your primary financial accounts.

Fizzswap currently supports the following crypto wallets. (based on October 7th, 2024)

Refer to the guide below to select and create a crypto wallet you want to use.

MetaMask equips you with a key vault, secure login, token wallet, and token exchange—everything you need to manage your digital assets. Over 21 million users worldwide trust and use Metamask.

⬛ Features:

▪️ Create and manage accounts with seed phrase

▪️ Supports for most types of networks and tokens

⬛ Official Link:

Teleport is a non-custodial blockchain wallet that operates within the Telegram app. Users can securely manage their crypto assets and interact with various dApps without the need for additional app installations or complex wallet setup processes.

⚠️ NEVER, in any situation, should you ever give someone your private key or recovery phrase ("seed phrase").

⚠️ The genuine Fizzswap site and staff will never ask you to input your seed phrase.

Token swaps are the simplest way to exchange various tokens circulated on the Silicon chain according to ratios of token pairs supplied in the pool.

Once users swap (trade) tokens through Fizzswap, the pool usage fees will be determined by the reward policy of each liquidity pool, and the pool usage fee will be distributed as follows.

Pool types

Composition of fee distribution

Liquidity Provider (LP)

80%

Governance

20%

80% of the pool usage fees incurred in all pools are distributed to liquidity providers in proportion to their respective LP shares.

20% of the pool usage fees incurred in all pools are distributed and accrued to the Governance.

1) Fizzswap's migration function usually goes through the following steps:

Approve (assets approval) - Remove the assets in the previous price range - Swap assets - Supply assets in a new price range.

2) To remove assets, users must have LP NFT assets corresponding to the supply certificate in their wallets, and the NFT asset approval transaction must be completed. Transaction fees (ETH) are incurred on the Silicon chain when a transaction is executed. The wallet owner has the right to transfer LP NFT assets, so if the asset is transferred to another wallet, removal is not possible.

3) During the removal process, the difference between the price at the time of supply and removal may result in asset loss.

4) Due to balance changes at the time of withdrawal, asset composition ratios and values are subject to change (see detailed V3 supply policy below), and all rewards (pool usage fee profits, airdrop tokens, etc.) distributed up to that point will be automatically credited to user's wallet.

5) For removed assets, the smart contract automatically swaps and supplies the assets at the optimal rate based on the pool exchange rate for the user's chosen price range. When a swap is required, the V2 and V3 pools are used as swap routes and transaction fees are incurred. Each pool has its transaction fee rate.

6) Supplies are made after swap fees are subtracted. When swapping, the larger the transaction size (quantity), the greater the effect on the exchange rate between tokens in the pool, resulting in a difference between the current price and the price applied at the time of the exchange (price impact). Multiple runs in small quantities can reduce the impact.

7) Depending on the transaction size, there may be a price difference (Price impact) at the time of exchange, so the expected exchange rate at the time of supply may not match the actual exchange rate. For this reason, supplies are only made within the transaction range (Slippage) set at the time of the swap, and if the range is exceeded, the supply transaction may be reverted (Revert). Proceed with the supply after checking all the information on estimated returns at the bottom.

8) Some assets may remain after supplying to the V3 pool, and the remainder will be automatically returned to the user's wallet.

This contract manages V3 pool airdrop operation. Operators with authority can set up and execute airdrops through V3Treasury contract. Airdrop is available only for token0 and token1.

Github Link: (Will be updated after official launch)

Silicon Mainnet :

You can directly deposit or withdraw ETH to/from the Silicon chain network through cryptocurrency exchanges that support multi-chain deposits and withdrawals.

Transfer your ETH from Korbit to your personal wallet (Silicon Mainnet) easily and conveniently, and start using it on Fizzswap!

1. Select the ETH withdrawal button on the asset menu.

2. Choose Silicon from the list of supported networks for ETH multi-chain deposits and withdrawals.

3. Enter the amount you want to withdraw and the destination address to complete the withdrawal process.

You can find the list of cryptocurrencies supported for Silicon chain deposits and withdrawals here:

1. Select [V3 Pool] from the [Pool] menu at the top. To migrate, click [Asset supplied] and then [Manage].

2. Click [Migration] on the V3 detail page.

3. Set the price range for migration. There are 3 ways to adjust the price range.

① Drag the “minimum price bar” and the “maximum price bar”

A 'price range' refers to the minimum and maximum price ranges in which an asset can be traded, and suppliers will receive pool usage fees if a transaction occurs within the price range.

When the token price of the supplied pool fluctuates, the ratio of assets in the pool changes. And if the token price falls outside the range due to drastic changes in token prices, suppliers will only hold one token from the token pair. In that case, supplied assets cannot be traded within the rages, so pool usage fees and rewards cannot be earned.

deployAirdropOperator

Parameters:

token

address

The address of token to airdrop

pool

address

The address of pool to be airdroped

Return Values:

operator

address

The deployed address of V3AirdropOperator

event DeployAirdropOperator(address operator);function deployAirdropOperator(

address token,

address pool

) external returns (

address operator

)⬛ Features:

▪️ Teleport facilitates the creation and growth of token-based Web3 communities

▪️ Teleport users can seamlessly participate in various airdrops through its deep integration with the Vennie service.

Wallet Connect is an open source protocol for connecting decentralized applications to mobile wallets with QR code scanning or deep linking. Wallet Connect is also multi-chain. You can connect to multiple wallets and send transactions to multiple chains at the same time without having to switch chains.

⬛ Features:

▪️ Not a wallet app, a protocol that supports connections between wallets and Dapps

▪️ Supports convenient connection with QR code on mobile

▪️ Supports over 100 types of wallets

⬛ Supported wallets: https://walletconnect.com/registry?type=wallet

⬛ Official Link:

Metamask

⭕

⭕

Teleport

⭕

⭕

Wallet Connect

⭕

⭕

Silicon Mainnet : 0x7C3ea90428BaF92a135E443ADA78F6170C349a78

Migrates liquidity to v3 by burning v2 liquidity and minting a new position for v3

Slippage protection is enforced via amount{0,1}Min, which should be a discount of the expected values of the maximum amount of v3 liquidity that the v2 liquidity can get. For the special case of migrating to an out-of-range position, amount{0,1}Min may be set to 0, enforcing that the position remains out of range

Parameters:

③ Click the [+] button or the [-] button in the “Set Price Range” section

※ Notes

Pools out of range will not distribute rewards, and supplying only one asset of the pair is available.

4. When migrating in the "Estimated Returns" section, click the [Migration] button after checking information.

All displayed information is a real-time estimate; therefore, information changes may occur during migration. Therefore, users should fully understand the possible changes that may occur during migration before making a transaction.

5. Confirm the estimated information in the "Check Migration Details" pop-up, such as the amount to be removed and the amount to be supplied after swapping, and then click [Next Step].

6. When you have approved the Fizzswap V3 LP NFT in the "Confirm Transaction" pop-up, click the [OK] button.

By proceeding with the migration transaction, you acknowledge that you have read, understood, and agreed to the terms of service for Fizzswap.

7. Click the [OK] button after checking the estimated information on the V3 pool supply in "Confirm Transaction." Once the information is confirmed, click [Confirm] in the wallet.

If no transactions occur within the suppliers' price range, the pools become inactive, making it impossible for suppliers to earn pool usage fee profits and additional rewards (token airdrop, etc.). If so, suppliers are required to remove their assets and re-supply them.

The Fizzswap V3 pool offers one-stop migration, allowing suppliers to migrate their assets with a single transaction. The detailed procedure consists of asset removal - supply in the new price range, and suppliers can migrate from the detail page of the pool they provided liquidity for.

*Case 1: If the token price changes to the Change2 state, transactions stop occurring in liquidity pool A, which makes pool A inactive.

*Case 2: If the token price changes to the Change1 state, transactions continue to occur in liquidity pool A, but the price might fall out of range and may turn into an inactive state.

▶ In both cases, suppliers can re-supply to a stable price range via migration and continue earning pool usage fee profit and rewards.

Please refer to the V3 Pair Deposit guide and policy.

This contract is Airdrop plan contract applied to the pool. You can target one liquidity pool and one token. The contract is executed by an operator with authority through Treasury.

Github Link: (Will be updated after official launch)

Contract address after production is deployed (scope link)

Introducing Fizzswap's AMM-based Instant Swap Protocol

AMM is an innovative trading mechanism that evolved from order book-based DEXs to change the way we trade cryptocurrencies on-chain. Instead of buy/sell order books, liquidity pools created by liquidity providers allow traders to trade freely, and liquidity providers share any generated pool usage fees as revenue in proportion to their individual liquidity contributions. In addition, any holder of Silicon Compatible Token can become a liquidity provider.

The AMM mechanism of Fizzswap is based on the formula x * y = k where x = ETH, y = Token1 , and k = Constant Function. The token price range is set according to the quantity of each token when the corresponding liquidity pool is created. For example, if the liquidity supply of x (ETH) increases, the supply of y (Token1) decreases to maintain the constant function, k. In this way, the supply of each token in the liquidity pool is designed to fluctuate with prices set accordingly.

Structures of Services:

Fizzswap provides a seamless way to exchange one token for another at a rate determined by the ratio of token pairs within the liquidity pool.

Additionally, Fizzswap offers a "single-asset supply" option in its liquidity pool (V2, V3) services. This feature allows users to supply liquidity to a pool using a single asset, even if they only hold one of the pair tokens. The platform will automatically swap the single asset to create the required pair and add it to the pool.

Fizzswap's Supply & Borrow service allows anyone to freely supply or borrow tokens. Users can maintain liquidity without swapping assets, while simultaneously borrowing desired assets for trading.

Suppliers receive aToken and LP rewards when supplying a single token to the pool, and can leverage the supplied asset as collateral to borrow other tokens.

Borrowers pay a borrowing fee (APY) to the liquidity pool in exchange for borrowing assets. A portion of the fees paid by borrowers is distributed to suppliers as LP rewards through a smart contract.

Fizzswap supports various way of providing liquidity.

When participating in V2 pools, users receive Liquidity Provider (LP) tokens representing their share of assets in the pool. V2 participants earn a portion of the pool usage fees generated in the pool and may receive additional rewards based on their LP share.

V3 pools offer concentrated liquidity, maximizing asset efficiency. Liquidity providers can specify a price range for their supplied assets, ensuring they're only used within that range. Through the Concentrated Liquidity Market Maker (CLMM) design, providers can allocate capital more efficiently, leading to higher pool usage fees earnings.

When supplying liquidity to V3 pools, users receive V3 LP NFTs as proof of their share. Similar to V2, V3 participants earn pool usage fees and may receive additional rewards based on their LP share.

*Note that slippage (a difference in the estimated price at the point of transaction and the actual price at time of transaction) may occur in AMM-based swap protocols. In addition, a liquidity provider may experience Impermanent Loss (change in price of supplied assets compared to when they are supplied) as token prices in pools are adjusted by an AMM mechanism after the point of supply.

Please keep these risks in mind when providing liquidity or conducting transactions.

Liquidity Providers (LPs) are ecosystem participants who supply assets in V3 pools. Fizzswap manages price ranges of concentrated pool with NFT. Users will receive Fizzswap V3 LP NFTs as proof of providing liquidity when they supply assets into liquidity pools.

The NFT represents ownership of the assets supplied, so users will continue to receive pool usage fee profit from that pool while their assets remain supplied.

When assets are removed from concentrated pools, the corresponding NFTs are automatically returned as they no longer provide liquidity.

params

struct IV3Migrator.MigrateParams

The params necessary to migrate v2 liquidity, encoded as MigrateParams in calldata

function migrate(

struct IV3Migrator.MigrateParams params

) externaltoken : ERC20 token address

amountPerBlock : Amount of airdrop tokens to be distributed per block

distributableBlock : Start block Number

targets : Array of liquidity pool addresses to distribute

rates : Array of liquidity pool distribution to distribute

Deposit

Event log of airdrop tokens deposit

Parameters

amount : Deposit token amount

totalAmount : Deposit token total amount

RefixBlockAmount

Event log of distribution token amount changed

RefixDistributionRate

Event log of liquidity pool distribution rate changed

ChangeDistributionRate

Event log of distribution rate changed

Distribute

Event log of user receives an airdrop tokens

Parameters

user : user address

target : LP address

amount : token amount

currentIndex : index

userRewardSum : total token amount

event Initialized(address token, uint amountPerBlock, uint distributableBlock, address[] targets, uint[] rates);event Deposit(uint amount, uint totalAmount);event RefixBlockAmount(uint amountPerBlock);event RefixDistributionRate(address[] targets, uint[] rates);event ChangeDistributionRate(address target, uint rate);event Distribute(address user, address target, uint amount, uint currentIndex, uint userRewardSum);ProposalCreated

event ProposalCreated(uint id, address proposer, address target, string signature, bytes callData, uint startBlock, uint endBlock, string description);Events log of proposals are created

Parameters

id : proposal ID

proposer : proposer's address

target : Address of the contract to be executed

VoteCast

Events log of vote

Parameters

voter : voter's address

ProposalCanceled

Events log of proposal canceled

ProposalQueued

Events log of proposal queued

ProposalExecuted

Events log of proposal executed

ProposalFeeSet

Events log of proposal fee(KSP) changed

Liquidity providers for the V3 pool will be compensated with pool usage fees based on their LP stake in the pool. The liquidity providers can claim the distributed pool usage fee at "claimable" and receive it directly in their wallets.

For pools conducting airdrop events, liquidity providers will be compensated with airdrop tokens based on their LP stake in the pool.

V3 pool suppliers provide liquidity at specific prices where they anticipate transactions occurring, and they receive pool usage fee profits when transactions occur in their assets (liquidity). However, if the current token price is out of the price range they supplied (out of range), supplied assets will no longer be used for swaps, and they will not be able to earn rewards distributed by the pool (swap fees and reward tokens). Thus, suppliers are required to manage their assets carefully to ensure the price ranges they supplied are valid (in range).

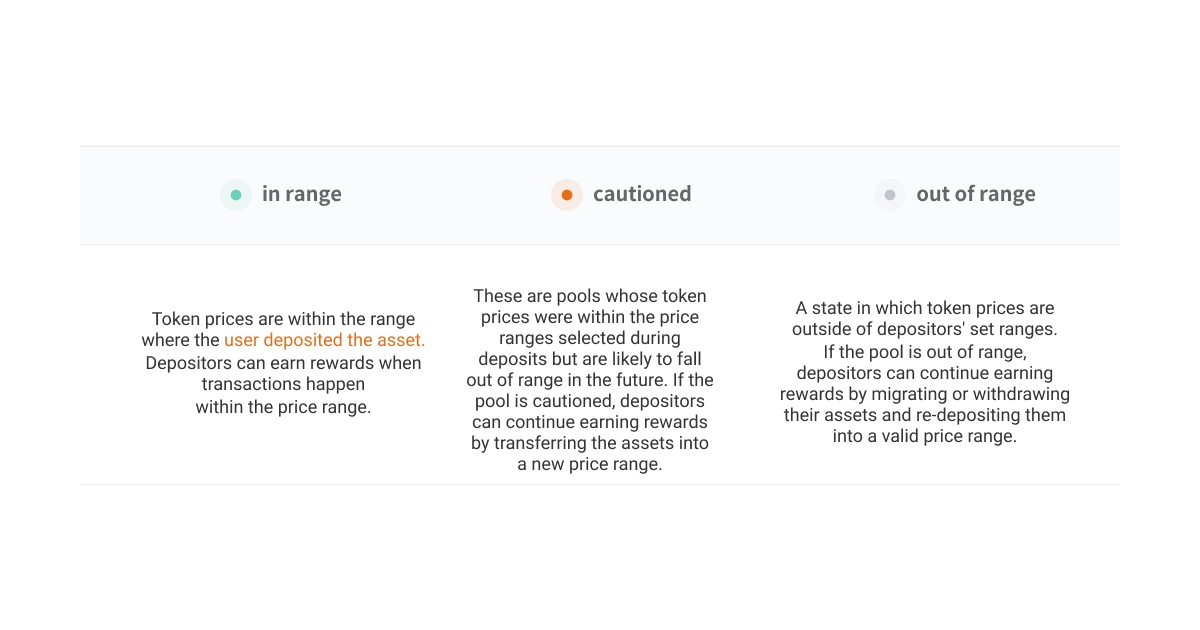

Concentrated pools fall into three categories: In range, Caution, or Out of range.

Please refer to the V3 MIGRATION Guides and Detailed Policy

This contract produces a string containing the data URI for a JSON metadata string

Github Link: (Will be updated after official launch)

Cypress :

The Helper smart contract is a contract that helps deposit LP with single token, even if you do not bring two tokens.

Github Link: (Will be updated after official launch)

Silicon Mainnet :

1. Under the [Pool] menu at the top, click [V3Pool].

2. Select the asset pool to supply from the pool list, and click [Supply] to see the details page.

3. Set price range. There are 3 ways to adjust the price range.

① Drag the “minimum price bar” and the “maximum price bar”

② Enter the “Minimum price” and “Maximum price” in the “Set Price Range” section

③ Click the [+] button or the [-] button in the “Set Price Range” section

4. Choose whether to supply both assets or a single asset.

Notes

If a supply is made in an inactive price range (Out of range), rewards will not be distributed. In this case, suppliers can only supply using one of the pair tokens.

5. Enter the amount you wish to supply once you have checked your token balance. If you are supplying in "Estimated Returns," you can check estimated information. When confirmed, click [supply].

Notes

The information displayed is based on real-time estimates, and changes may occur while supplying. It is highly recommended that users fully understand any changes that may arise during the supply process.

6. Click the [supply] button after you have reviewed the estimated returns of the V3 pool on the "Confirm Transaction" pop-up. Once you have confirmed the information, click your wallet's [Confirm] button.

Prior to executing the supply transaction, you must agree to the Fizzswap Terms of Service by indicating your acceptance.

7. Upon completing the supply, you can check the reward information (commission, cumulative profit) in the "You Earned" and "Management." Rewards are distributed in real-time based on real-time expected returns.

The "max" button allows you to enter the maximum quantity.

signature : signature of the function to be executed

callData : function data to be executed

startBlock : start block number

endBlock : end block number

description : proposal details

proposalId : proposal IDsupport : support

votes : Number of vote vKSP

againstVotes : Number of total against vote

forVotes : Number of total favor vote

quorumVotes : Number of proposal quorum

reason : reason

Function used to propose a new proposal

Sender must have delegates above the proposal threshold

target : Target address for proposal calls

signature : Function signature for proposal calls

callData : Calldata for proposal call

description : String description of the proposal

Function used to cast a vote for a proposal

proposalId : The id of the proposal to vote on

support : The support value for the vote. false=against, true=for

event VoteCast(address voter, uint proposalId, bool support, uint votes, uint againstVotes, uint forVotes, uint quorumVotes, string reason);event ProposalCanceled(uint id);event ProposalQueued(uint id, uint eta, uint tid);event ProposalExecuted(uint id, bool succeeded);event ProposalFeeSet(uint oldProposalFee, uint proposalFee);function propose(address target, string memory signature, bytes memory callData, string memory description) public returns (uint)function castVote(uint proposalId, bool support) external token

address

The token being given priority order

priority

int256

Represents priority in ratio - higher integers get numerator priority

function tokenURI(

contract INonfungiblePositionManager positionManager,

uint256 tokenId

) external returns (string)Produces the URI describing a particular token ID for a position manager

Note this URI may be a data: URI with the JSON contents directly inlined

Parameters:

Return Values:

event UpdateTokenRatioPriority(

address token,

int256 priority

)lp : Address of LP token

token : Token address to be deposited

amount : Amount of token not to be swapped

swap : Amount of token to swap

validPool : Whether it is a pool with KSP rewards

Returns

estLP : Expected number of LP token to be minted

realInput : Actual number of input amount

estTarget : Amount of tokens to be receivedthrough swap

estimateSwapAmount

Method to change the mining weight per liquidity pair

Parameters

lp : Address of LP

token : Token address to be deposited

amount : Amount of token to be deposited

Returns

maxLP : Expected number of LP token to be minted

maxSwap : Expected amount of token to swap

addLiquidityWithETH

Method to add liquidity only providing ETH.

Parameters

lp : address of LP token

limit : Minimum amounts of LP tokens to be minted.

inputForLiquidity : Expected amount of ETH to provide LP

addLiquidityWithToken

Method to add liquidity only providing single ERC20 token.

Parameters

lp : address of LP token

function estimateLP(address lp, address token, uint amount, uint swap, bool validPool) public view returns (uint estLP, uint realInput, uint estTarget)Silicon Mainnet : 0xF54463D69B1D9AB3400A270D2a474720Cd63Fec2

ChangeCreationFee

event ChangeCreationFee(uint fee);Event that occurs when the creation fee (KSP) is changed

SetOperator

event SetOperator(address operator, bool valid);Event that occurs when setting operator

CreateDistribution

Event that occurs when airdrop is set

RemoveDistribution

Event that occurs when airdrop is removed

Deposit

Event that occurs when token deposit

RefixBlockAmount

Event that occurs when airdrop distribution amount

RefixDistributionRate

Event that occurs when airdrop distribution rate

Please be aware that the use of Fizzswap has the following risk factors.

• Fizzswap is a blockchain decentralized protocol without a central entity. Users participate in transactions through liquidity pools on the blockchain created by other users at their own responsibility and judgment. This may lead to users being unable to receive recovery support from someone or Fizzswap for the results of an user's mistake, so it is always recommended to test with a small amount first to manage the risk caused by mistakes(mistransfers, etc.).

• All assets and asset liquidity pools identified on the Fizzswap website are tokens on the Silicon chain that are self-registered by users without going through individual screening, and their safety is not guaranteed by the Fizzswap team.

• Based on the nature of the AMM (Automated Market Maker) method, the asset price a user receives on Fizzswap can vary significantly depending on the swap size, the amount(ratio) of assets currently waiting in the pool(percentage), and the changes to pool's real-time supply and removal of liquidity.

• Asset price fluctuations may cause assets to be deposited or withdrawn from the pool at prices or ratios that users did not expect. Also, if there is a price change from the price at the time of depositing in the pool, you may incur a loss when withdrawing, compared to the case that you simply hold the asset.

• All Figures displayed on the website are estimated information provided to help users make decisions, and do not guarantee the timeliness, suitability or accuracy of the data.

• A normal Fizzswap website never asks for the user's personal wallet private key, mnemonic key, and seed phrase to be entered.

• For other risk factors, precautions, and conditions of use, please check the link below.

Fizzswap is a decentralized application (DApp) based on Silicon Chain which is developed by a third party. Fizzswap is designed to provide users with an easy-to-use interface such as Fizzswap website(https://fswap.io) (Hereinafter Fizzswap and Fizzswap website are collectively referred to as the “Fizzswap”) to the decentralized protocol that integrates directly with Silicon blockchain wallet of a user, to swap various digital assets and to provide liquidity.

NOTICE: This guideline contains the terms and conditions by which you may access and use the Fizzswap. Please read this guideline carefully. By accessing or using the Fizzswap after you check this guideline, you signify that you have read, understand, and agree to be bound by the terms and conditions in its entirety.

The contents of this document can be revised at any time for the purposesreasons such as change, addition, deletion, supplementation, user protection, and error correction of Fizzswap. If the content of this document is revised, the revision will take effect from the time the changed contents is posted. However, if the content to be changed is unfavorable to the user or is a significant change, it will be posted 30 days before the effective date. If the user checks the revised document after the effective date and continues to use Fizzswap, it is deemed that such user has read, understood and agreed to the revision.

• To use Fizzswap, an user must be at least the age of majority in civil terms in his/her country (ex: 21 years of age in Singapore). Also, a user must be able to make a statement that you have full rights and authority to enter into and comply with civil agreements on behalf of yourself or any legal entity that you represent.

• An user must be able to make a statement that a user is (i) not subject to any economic or trade sanctions by any governmental authority (including, but not limited to, the Office of Foreign Assets Control of the U.S. Department of the Treasury, etc.); (ii) is not citizens or residents of any jurisdiction subject to comprehensive economic sanctions by the United state, and will not use Fizzswaps for the purpose of illegal activity conduction, promotion, or designing.

For reliable network/service while using Fizzswap, please read the following guideline carefully.

• It is recommended that you access the service with only one instance/tab.

• The service may be limited if you use multiple instances/tabs for prolonged period of time, using a public/shared IP access point and/or there is an excessive amount of connection requests.

• If you are having difficulty with connectivity for whatever reason, please close all instances/tabs and access the service after at least 1 hour before re-connecting.

Users should be aware of the following when suppling and removing assets.

• To request a transaction, the user must have a Silicon wallet to hold Silicon-based assets, along with a minimum amount of Silicon (ETH) to use for transaction fees

• Liquidity on the Silicon chain is provided with Silicon-Compatible Tokens issued on the Silicon chain. Hence, an asset that is not a Silicon-compatible Token and based on other blockchains, including but not limited to Ethereum, Ripple, BSC, must be converted into a Silicon-compatible format through bridging protocol(e.g., Oribit Bridge) prior to being deposited into Fizzswap.

Users must accurately check the asset type and address when transferring assets between wallets. If a user transfers a type of asset that is not supported by Silicon Chain, or if the required transfer address is not entered or entered incorrectly, such transfer may not be properly processed and assets may be irreversibly lost.

Please refer to the link below for more information regarding mis-transfer of assets.

• Even for some assets (e.g., Ripple, XRP) that are heterogeneous chain’s assets from Silicon, which can be transferred between wallets directly through the Fizzswap interface without going through the bridge site, the user must accurately enter the transfer address and destination tag assigned to each wallet. If the transfer address or destination tag is not entered or entered incorrectly, such transfer may not be properly processed and assets may be irreversibly lost.

• Fizzswap is a decentralized application in which the private key of user assets is not managed by a central entity. Fizzswap has such structure in which asset recovery or/and technical support from a central entity are impossible for the consequences from users' mistake or negligence including but not limited to wrong transactions described above. This structure is designed so that if a user transfers an asset incorrectly, no one, including Fizzswap, can access the asset. Due to the decentralized nature like this, capabilities and responsibilities of Fizzswap team for mis-transfer may not be similar to the support of many centralized exchanges(e.g., Upbit, Bithumb, Coinone, ect.) for technical and structural reasons

• To prevent losing assets, we recommend that users test with a small amount of assets prior to sending a larger amount.

• For supply and mis-transfer occurring as a result of using Silicon Bridge, please refer to the respective site’s policies.

You can act as a Liquidity Provider by providing liquidity to a Liquidity Pool(e.g., Single pool, V2/V3 pool) in Fizzswap; however, you must carefully evaluate and consider the risk before proceeding with the transaction, and take responsibility for your own actions and judgments.

Fizzswap works based on the AMM(Automated Market Maker) method. Price of each token within Fizzswap is determined by the liquidity pool ratio of tokens within the relevant Smart Contract. As automated Smart Contract makes adjustment to price as per the formula (x*y=k), the price shown on Fizzswap interface may not be the same as prices shown at other exchanges, and cannot be guaranteed for accurate or appropriate market prices.

• Each token price at the time a user supplies, removes, or swaps assets is determined by the above price measurement method (exchange ratio of token pairs), and the price is not directly proportional to the exchange quantity.

• In addition, as the exchange rate of token pairs momentarily changes due to the real-time participation of various participants, the price displayed on the Fizzswap website right before the transaction may change at the time of the transaction, and the price applied at the time of the actual transaction may vary. (e.g., Transactions occur in token pairs, asset supply and removal of token pairs, etc.)

• The Fizzswap Protocol has a stabilization measure so that the request can be executed only within a certain range of the exchange rate to be applied by the user in order to minimize the loss that may occur due to the large change in the current exchange rate, but you should precisely check and confirm the exchange rate applied to the time of transactions when proceeding liquidity supply, removal, and swaps.

All reward APRs displayed on Fizzswap's website, including the Liquidity Supply APR, FIZZ Distribution APR, Airdrop APR, Pool Fee APR for using the protocol, Staking APR, and Utilization APR for using a Single Liquidity (Supply), are estimates of the rewards distributed on an annualized basis, and are not guaranteed.

For more details regarding rates of returns displayed, Please refer to below link

• In particular, at 9 a.m. (KST) every day, the FIZZ APR of each liquidity pool is updated reflecting the FIZZ Mining rate aggregated from the user pool vote and the FIZZ buyback quantity per pool. At this time, the figure that indicates FIZZ distribution APR includes the quantity allocated to the vFIZZ Holder(5%), development team (5%), Treasury(5%), Partner(5%) and the rewards that users actually receive is the amount that the quantity allocated for the team is excluded.

• Fizzswap strives to provide accurate information in real time as much as possible, but the expected APR displayed in the screen may vary from the actual APR due to price fluctuations of distributed tokens, changes in liquidity pool size, and delays in transaction processes.

• For details on calculating the expected APR, please refer to the relevant documentation on the Fizzswap website.

Users can earn returns from token supply distribution rewards, and token airdrop by supplying two types of assets (pairs) on Fizzswap.

There may be delays when supplying pair liquidity. You can find out more details in the link below.

In the event that the market price of an asset that a user supplies changes significantly from its price at the time of supply, the user is more likely to receive a lower reward than if the asset was not supplied, and even incur a mark-to-market loss. These losses, however, become permanent when a user withdraws their assets from the pool (due to this nature, we refer to these losses as impermanent losses, see the link below for more information), and if the price difference between the price of the user's assets in the self-supply state before the user withdraws user's assets and the price when the user supplied user's assets to the pool is restored, then the actual loss may be reduced. Moreover, users' overall rewards should be calculated taking into accoun pool usage fee rewards. For more information on impermanent losses, please refer to the links below.

Fizzswap V3 (Version 3) has a Concentrated Liquidity function. This notice refers to the liquidity pool with centralized liquidity as the 'V3 pool' and to the liquidity pool with the previous features as the 'V2 pool'.

Due to its principle of operation, the V3 pool provides users with more freedom and choice for centralizing liquidity supply and designating a supply section and, therefore, may hold higher reward expectations and greater loss risks than the V2 pool.

The V3 pool liquidity providing risks compared to the V2 pool liquidity providing are as follows. The narrower the designated price range becomes, the higher the chance of (i) a rise in the risk of impermanent loss (IL; Impermanent Loss), (ii) a rise in the risk of changing the composition ratio and value of supplied assets (There is also the possibility that the ratio of the two assets is fixed at 100:0 at the time of removal), (iii) a rise in the likelihood of not being able to obtain supply rewards when the token's price departs from the user's specified range, (iv) a rise in the risk of loss due to price range migration (V3 to V3 migration) when the price is out of the price range. For more information, please refer to the link below.

Concentrated liquidity introduction, background and precautions (Link) V3 Pool Supply Details Policy (Link)

As the V3 pool liquidity providing has high structural complexity and is difficult to predict the risk of asset loss (particularly when the liquidity is provided in a narrow price range), it is not recommended for users with little experience in investing in virtual assets and the personality that cannot handle the possibility of loss. Users must carefully evaluate and consider the risks of concentrated liquidity before supplying and managing liquidity to liquidity pools.

Users must comply with this guide's precautions and not engage in the following actions.

• Activities that harm or disrupt the sound trading order of Fizzswap

• Activities that disrupt or negatively affect the operation of Fizzswap (including but not limited to Fizzswap interfaces, Fizzswap protocols, etc.) through automated or other fraudulent methods such as Agents, scripts, spiders, spyware, toolbars, etc.

• Activities that defame the Fizzswap team or interfere with their work

• Providing inaccurate, incorrect, or misleading information while using Fizzswap

• Activities of taking the assets of Fizzswap users or engaging in taking the authority of the user's wallet without justifiable cause

• Activities that use proceeds directly or indirectly related to all forms of criminal activity (e.g., terrorism activity, tax evasion, etc.) when using Fizzswap

• Impersonating someone other than yourself during the communication with Fizzswap support team

• Other illegal acts in violation of any applicable laws and regulations

• Fizzswap is a web-app interface that allows users to use their Silicon blockchain wallet to communicate with a decentralized protocol to swap assets and to provide liquidity. This means Fizzswap wields no control over individual Liquidity Pools, or the trust of a swap. It is the user’s responsibility to carefully consider the benefits and risks related, by taking into consideration token price ratio at the moment of swap, and all the necessary information to evaluate such risks.

• Expected APR, token price, an example of reward calculation, and all other information provided by Fizzswap interface help users make informed decisions for using Fizzswap or decentralized financial transactions such as providing liquidity, removing liquidity, and swapping. The information provided here is not a suggestion or a hint to invest or trade. Fizzswap makes a reasonable effort to deliver accurate information but does not guarantee the timeliness or accuracy of the information.

• Fizzswap is not responsible for user loss of assets, and for generating less rewards than projected, resulting from the use of Fizzswap.

• Fizzswap does not guarantee the continuity of Fizzswap service, and of the functions within. Any service or functions provided within Fizzswap can be added or deleted permanently, and Fizzswap itself may be stopped or changed. (In the case of a permanent stoppage of Fizzswap service, users that may be affected will be given a reasonable period (30days or more) and notifications/guide.)

• Fizzswap does not guarantee the reliability of Silicon blockchain platform used by Fizzswap Protocol, as well as any other third party services.

• There is no responsibility or authority on the part of Fizzswap for the contract execution technology set by a third party. Token issuing individuals or foundations that own the wallet (Deployer) with the corresponding authority, may stop, change, or suspend the execution of the token contract, and such changes may affect and limit the ability to supply or remove assets from the liquidity pool (LP) within Fizzswap. Thus, the inability to remove assets due to the execution of a specific token contract authority is unrelated to the functionality provided by Fizzswap (supplying and removing assets from autonomously created pools). Since Fizzswap does not have independent control over the user's private cryptographic keys, it is not structurally possible for Fizzswap to arbitrarily access, control, or intervene in the assets held in the liquidity pool, such as sending them to a specific address, which requires the action of the token contract holder's wallet associated with the liquidity pool pair causing the issue.

• Developers, operators and governance participants of Fizzswap do not endorse, guarantee, or assume responsibility in any way for any and all part of Fizzswap to the fullest extent permitted by law.

• Due to the complexity of software code and the nature of technology, the perfect integrity of the code cannot be guaranteed. Smart Contract codes used in Fizzswap may be susceptible to vulnerabilities which cannot be prevented by due diligence in the industry, and risks of asset loss exist(e.g., hackings or flash loan exploits utilizing those vulnerabilities).

• There is a continuous effort to maintain the block sync between Fizzswap and Silicon network; however, Fizzswap interface may be stopped without prior notice due to problems in the network resulting from transaction congestion, computer system errors and software attacks and other factors, such as natural events. Fizzswap is not guaranteed to work at all times.

• In aforementioned situations and more, there may be errors in the values/information displayed on the interface, as well as stoppage of service connection. User requests for swap, deposit, withdrawal and other transactions may be delayed or fail.

• Fizzswap, OUR DEVELOPERS, EMPLOYEES, OFFICERS, OPERATORS, AFFILIATES, AND GOVERNANCE PARTICIPANTS(HEREINAFTER, REFERRED TO AS THE “WE” OR “US” IN THIS AND NEXT SUBSECTIONS), MAKE NO WARRANTIES, EXPRESS OR IMPLIED, GUARANTEES OR CONDITIONS WITH RESPECT TO YOUR USE OF Fizzswap. YOU UNDERSTAND THAT USE OF Fizzswap IS AT YOUR OWN RISK AND THAT WE PROVIDE Fizzswap ON AN "AS IS" BASIS AND "AS AVAILABLE." YOU BEAR THE ENTIRE RISK OF USING Fizzswap. YOU ACKNOWLEDGE THAT COMPUTER, SOFTWARE, TELECOMMUNICATIONS SYSTEMS, AND BLOCKCHAIN SYSTEM ARE NOT FAULT-FREE.

• YOU UNDERSTAND AND AGREE THAT WE SHALL NOT BE LIABLE TO YOU FOR: ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL CONSEQUENTIAL OR EXEMPLARY DAMAGES WHICH MAY BE INCURRED BY YOU, HOWEVER CAUSED AND UNDER ANY THEORY OF LIABILITY.. THIS SHALL INCLUDE, BUT NOT BE LIMITED TO, ANY LOSS OF PROFIT (WHETHER INCURRED DIRECTLY OR INDIRECTLY), ANY LOSS OF GOODWILL OR BUSINESS REPUTATION, ANY LOSS OF DATA SUFFERED, COST OF PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES, OR OTHER INTANGIBLE LOSS. UNDER NO CIRCUMSTANCES SHALL WE BE LIABLE TO YOU FOR ANY CLAIMS, PROCEEDINGS, LIABILITIES, OBLIGATIONS, DAMAGES, LOSSES, OR COSTS IN THE AMOUNT EXCEEDING THE ABOUNT YOU PAID US IN EXCHANGE FOR ACCESS TO AND USE Fizzswap, OR USD$100.00, WHICHEVER IS GREATER. THIS LIMITATION OF LIABILITY SHALL APPLY TO THE FULLEST EXTENT PERMITTED BY LAW.

In the following cases, the measures to user's access information (e.g., wallet address, access information, etc.) to the Fizzswap website may be taken as reasonably necessary, such as being provided to a regulatory authority or judicial authority.

• When there are reasonable grounds to believe that the relevant asset is involved in hacking, money laundering, or other criminal activity

• When requested by a regulatory or judicial authority based on the applicable laws and regulations

Any dispute arising out of or in connection with these terms including any question regarding its existence, validity or termination and any dispute arising out of or in connection with users’ access or use of Fizzswap, shall be referred to and finally resolved by arbitration administered by the Singapore International Arbitration Centre (“SIAC”) in accordance with the Arbitration Rules of the Singapore International Arbitration Centre ("SIAC Rules") for the time being in force, which rules are deemed to be incorporated by reference in this clause. The seat of the arbitration shall be Seoul or Singapore. The Tribunal shall consist of one arbitrator. The language of the arbitration shall be English.

Fizzswap team has received professional security audits on Fizzswap from credible professionals in the industry, and is in its continuous effort to improve security and to minimize vulnerabilities.

Besides commercially reasonable means of communication (e.g., social media links posted on the Fizzswap website), Fizzswap can send out notices or inform its users through other commercially reasonable methods. Notices provided by Fizzswap using public communication means are effective immediately

This revision regarding the service will be effective from October 7th, 2024.

Service Agreement Change History

October 7th, 2024 : Initially declared

This contract is responsible for the ecosystem behavior related to staking RewardToken. Voting rights (vRewardToken) are issued according to the staking quantity and period.

Github Link: (Will be updated after official launch)

Silicon Mainnet :to-be

1) Users can supply assets directly by entering the pool's exchange rate (price) that corresponds with the price range they are currently supplying.

2) Users can supply when they have two assets or even just one. In the case of two asset supplies, no swap occurs, but in the case of a single asset supply (A or B), the smart contract swaps and supplies assets at the optimal ratio based on the current pool exchange rate. If a swap is required, V2 and V3 pools are used as swap paths and transaction fees apply. Fees are based on the pool's transaction fee rate.

3) Supplies are made after swap fees are subtracted. When swapping, the larger the transaction size (quantity), the greater the effect on the exchange rate between tokens in the pool, resulting in a difference between the current price and the price applied at the time of the exchange (price impact). Multiple runs in small quantities can reduce the impact.

function addLiquidityWithETH(address lp, uint limit, uint inputForLiquidity, uint targetForLiquidity) public payablefunction estimateSwapAmount(address lp, address token, uint amount) public view returns (uint maxLP, uint maxSwap, uint targetAmount)positionManager

contract INonfungiblePositionManager

The position manager for which to describe the token

tokenId

uint256

The ID of the token for which to produce a description, which may not be valid

String

string

URI of the ERC721-compliant metadata

function flipRatio() public returns (bool)function tokenRatioPriority() public returns (int256)targetAmount : Amount of tokens to be received through swap1% slippage allowed

targetForLiquidity : Expected amount of target token to provide LP

1% slippage allowed

msg.value : ETH amount of token to be provided.

token : Token address to be depositedamount : Amount of token to be deposited

limit : Minimum amounts of LP tokens to be minted.

inputForLiquidity : Expected amount of input token to provide LP

1% slippage allowed

targetForLiquidity : Expected amount of target token to provide LP

1% slippage allowed

totalAmount

uint256

Total number of tokens to be distributed by airdrop

blockAmount

uint256

Token quantity to be distributed per block

startBlock

uint256

Airdrop start block number

deposit

If there is an issue of token exhaustion or extension during the airdrop process, tokens can be recharged using the AirdropOperator's Deposit function.

When executing the function, transfer more than the amount of tokens entered into the wallet.

The token specified when creating the operator is charged.

When recharging due to exhaustion, it will be applied from the block after recharging.

refixBlockAmount

Modify the amount of tokens distributed per block

It is applied from the block after the transaction is executed.

withdraw

The remaining tokens can be withdrawn after the Airdrop plan is in progress.

Withdrawal will be made to the owner's account.

totalAmount

uint256

The total amount of airdrop

blockAmount

uint256

The airdropped amount of token per block

distributableBlock

uint256

The block number of available block

endBlock

uint256

The block number of airdrop ended

distributed

uint256

The amount of current distributed

remain

uint256

The amount of remained

created

bool

initialized

id

bytes32

The ID of the distribution

mapping(address => mapping(uint => address))

Number of distribution address each LP

distributionOperator

mapping (address => address)

Operator address each distribution address

fee

Distribution create fee

owner

owner

claim

Method that a user calls to claim the claimable airdrop tokens that has accumulated for the pair

Parameters

target : LP address

createTokenDistribution

Method of ERC20 distribution create

only Operator

depositToken

Method of KIP7 deposit to airdrop

only Operator

refixBlockAmount

Method of change the amount paid per block

only Operator

refixDistributionRate

Method of airdrop distribution rate change

only Operator

removeDistribution

Method of airdrop distribution remove

only Operator

event CreateDistribution(address operator, address token, uint totalAmount, uint blockAmount, uint blockNumber, address[] targets, uint[] rates);event RemoveDistribution(address operator, address token);event Deposit(address operator, address token, uint amount);function addLiquidityWithKCT(address lp, address token, uint amount, uint limit, uint inputForLiquidity, uint targetForLiquidity) publicfunction getDistributionId() public view returns (bytes32 id)function changeNextOwner(address _nextOwner) externalfunction changeOwner() externalfunction createDistribution(

uint256 totalAmount,

uint256 blockAmount,

uint256 startBlock

) externalfunction deposit(uint256 amount) externalfunction refixBlockAmount(uint256 blockAmount) externalfunction withdraw(address _token) externalevent RefixBlockAmount(address operator, address token, uint blockAmount);event RefixDistributionRate(address operator, address token, address[] targets, uint[] rates);function changeCreationFee(uint _fee) public function claim(address target) publicfunction createTokenDistribution(address token, uint amount, uint blockAmount, uint blockNumber, address[] memory targets, uint[] memory rates) publicfunction depositToken(address token, uint amount) publicfunction refixBlockAmount(address token, uint blockAmount) publicfunction refixDistributionRate(address token, address[] memory targets, uint[] memory rates) publicfunction removeDistribution(address operator, address token) publicuser : user address

lockPeriod :

4 months : 10,368,000

8 months : 20,736,000

12 months : 31,104,000

unlimited : 1,555,200,000

rewardTokenAmount : A Number of RewardToken

totalLockedRewardToken: Total number of staked RewardToken

totalLockedvRewardToken: Total number of users' vRewardToken

unlockTime : Available unstaking time (timestamp)

UnlockRewardToken

Event log of RewardToken unstaking

Parameters

user : user address

vRewardTokenAmount : Number of vRewardToken

rewardTokenAmount : Number of RewardToken

UnlockRewardTokenUnlimited

Event log that occurs when unstaking vRewardToken unlimited

Parameters

user : user address

vRewardTokenBefore : The amount of vRewardToken held

vRewardTokenAfter : Amount of vRewardToken held after unstaking

rewardTokenAmount : Amount of RewardToken staked

unlockTime : Available unstaking time (timestamp)

RefixBoosting

Event log of staking period is changed

Parameter

user : user address

lockPeriod : period

boostingAmount : Number of vRewardToken after period changed

unlockTime : Available unstaking time (timestamp)

ChangeMiningRate

Event log of daily RewardToken distribution rate changed

GiveReward

Event log of when mined RewardToken is claimed and distributed

Compound

Event log of when mined RewardToken restaking.

The compound amount can be entered in integer units

The amount minus the compound amount from the mined amount is returned to the wallet.

balanceOf

Number of vRewardToken tokens held by each address

getCurrentBalance

Number of vRewardToken tokens held by each address recent snapshot

getUserUnlockTime

Possible time of unstaking

lockedRewardToken

Number of RewardToken tokens stakes

mining

RewardToken distribution rate

It is a value between 0 and 10000, in units of 0.0001%

snapShotBalance

Number of vRewardToken tokens held by each address and snapshot

snapShotCount

Number of snapshot index each address

getPriorBalance

Historical user vRewardToken holdings per block

Parameter

user : user address

snapShotBalance

Historical vRewardToken holdings each address

Parameter

user : user address

lockRewardToken

Method for RewardToken staking

The amount can be entered in integer units

unlockRewardToken

Method for RewardToken unstaking

Unstaking is only possible during the unstaking period.

unlockRewardTokenUnlimited

Method for unstake RewardToken unlimited

Changed to x4 staking from execution

refixBoosting

Method for RewardToken staking period change

claimReward

Method that a user calls to claim the claimable RewardToken

compoundReward

Method for mined RewardToken staking

Can be called when the reward is 1 RewardToken or more

It is possible to stake in integer units, and the rest is to the wallet address.

event LockRewardToken(

address user,

uint256 lockPeriod,

uint256 rewardTokenAmount,

uint256 totalLockedRewardToken,

uint256 totalLockedvRewardToken,

uint256 unlockTime

)4) Depending on the transaction size, there may be a price difference (Price impact) at the time of exchange, so the expected exchange rate at the time of supply may not match the exchange rate. For this reason, suppliers are only made within the transaction range (Slippage) set at the time of the swap, and if the range is exceeded, the supply transaction may be reverted (Revert). Proceed with the supply after checking all the information on estimated returns at the bottom.

5) After-supply changes in asset composition

When assets are supplied in a specific price range, their composition ratio and value may change. Even when users hold two token positions at the time of deposit, if the current trading price of the token is out of the price range supplied, users' supplies will be converted to a position holding one asset with a lower value.

Suppose a user supplies assets in the price range of 1 ETH = 1,000 USDC to 1 ETH = 3,000 USDC in the ETH/USDC pair, and the ETH price drops below 1,000; in that case, their assets are converted into ETH tokens. In contrast, users' supplies will only be held in USDC tokens if ETH prices rise above 3,000 USDC.

Therefore, the user may receive (remove) assets with a different asset composition than at the time of the initial supply, depending on the current token price.

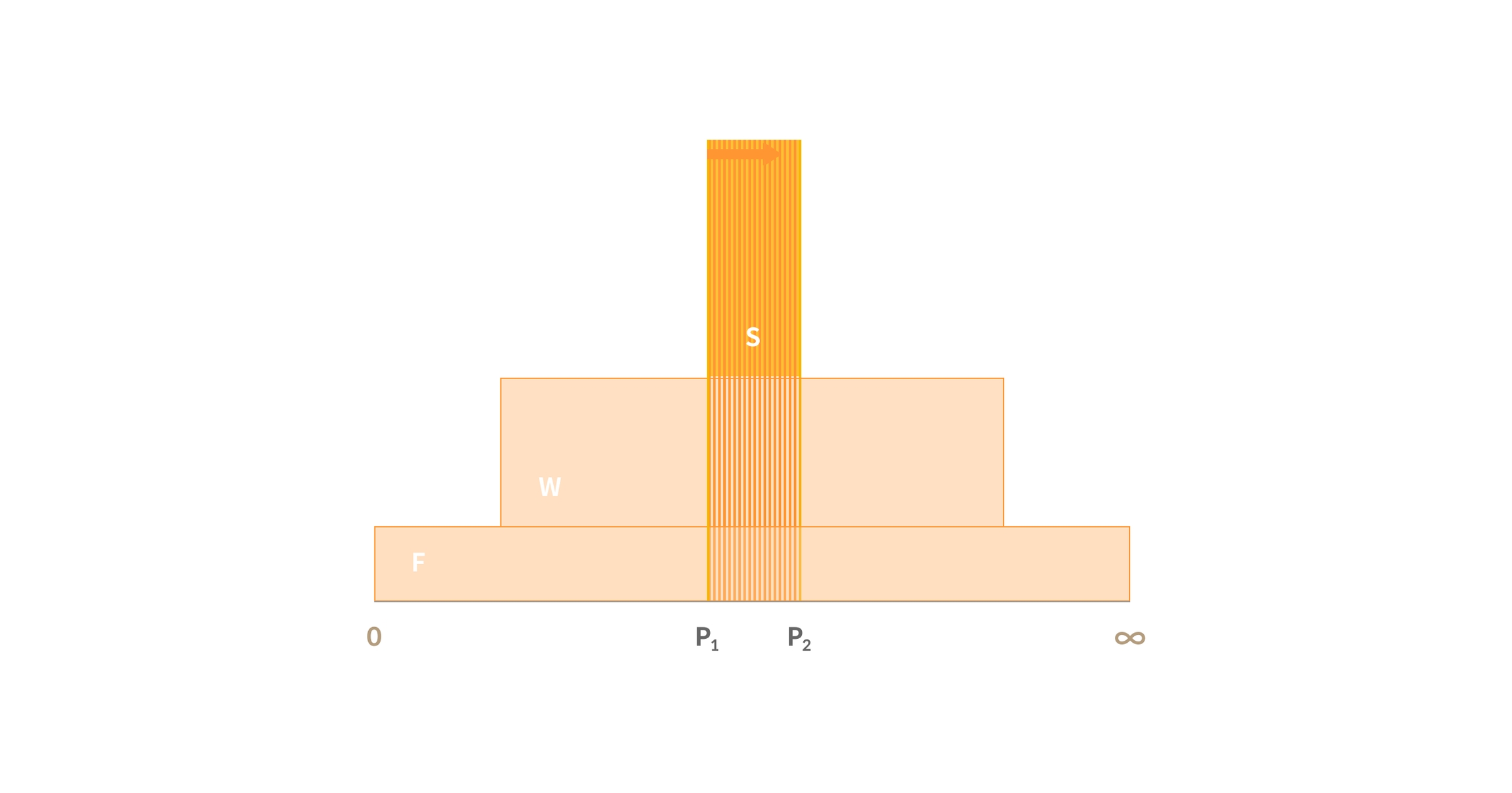

6) No Rewards when the pool is out of range.

In a V3 pool, assets are supplied in a specific price range where a transaction is expected to occur, and pool usage fees are distributed when the asset (liquidity) is actually traded. Therefore, if the current token trading price is out of the user-supplied price range, the rewards typically distributed in the pool will not be distributed. To obtain continuous compensation, suppliers must check the pool status (in range, caution, out of range) to see if a transaction occurs within the price range they supplied or migrate or remove the asset and re-supply it in the valid price range.

7) V3 pools, which intensively supply liquidity in a specific price range, may result in greater impermanent losses than V2 pools. If token prices fluctuate greatly, supplying within a narrow price range may result in significant impermanent losses. For this reason, suppliers should consider the possibility of impermanent loss and prepare for token price fluctuations before supplying their assets in the V3 pools.

8) V3 pool rewards (pool usage fees, KSP, and airdrop tokens) can be claimed directly from the detail page.

All rates of return (%) fluctuate according to real-time conditions, such as pool usage fees for each pool, token prices, stakes and concentration levels of users, and the active status of deposited assets.

*All examples of pool usage fee profit were based on the assumption that 100% of the pool usage fees generated from the V3 pool are distributed to liquidity providers (LPs, depositors). Therefore, distribution rates for liquidity providers may vary depending on governance.

<Policy on the Distribution of Pool Usasge Fee Profit>

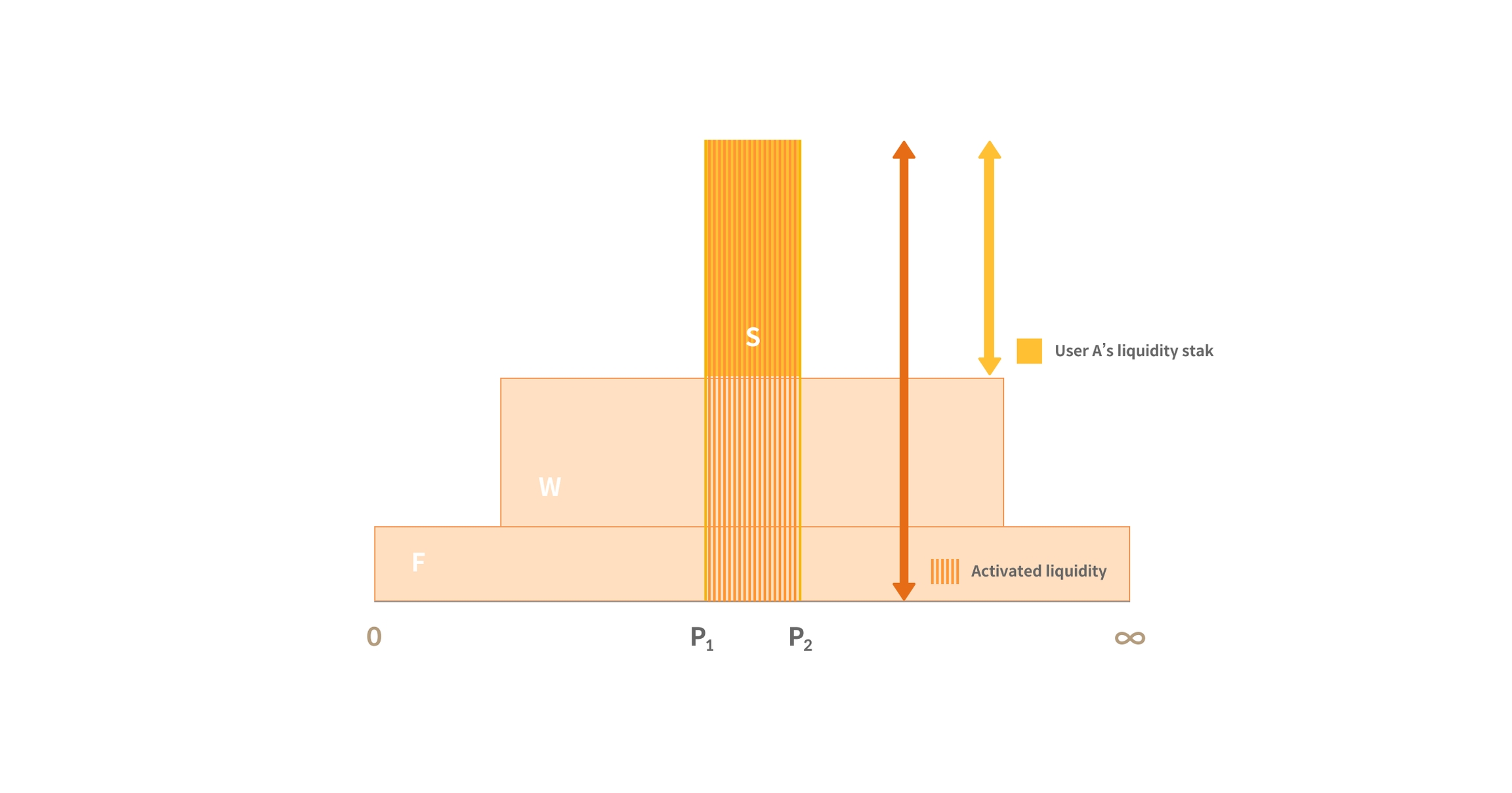

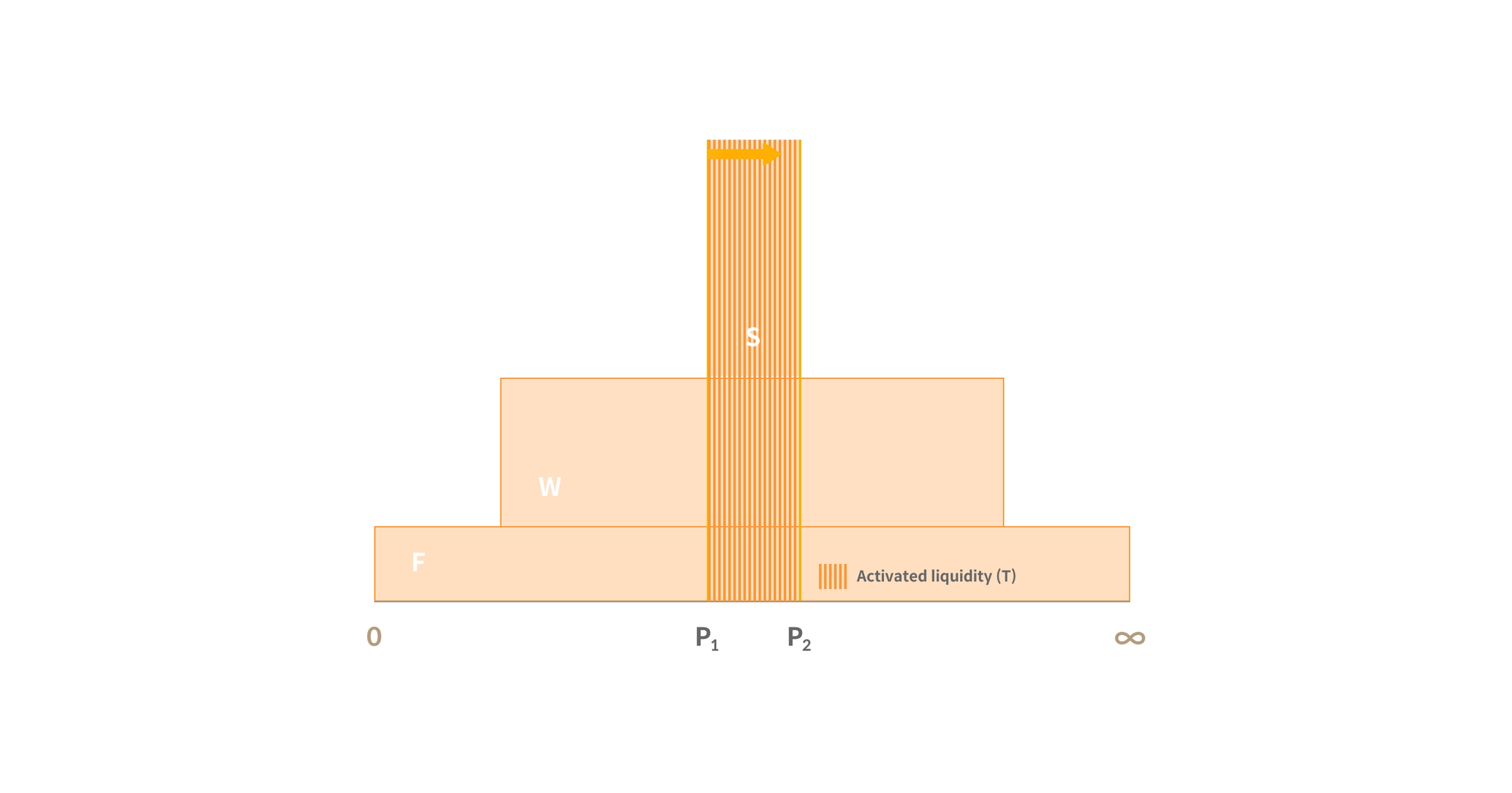

* Distribution Fee = Pool usage fee * (User’s liquidity(A)/ Utilized liquidity(T))

Pool usage profit is distributed when a transaction occurs within the supplied price range and according to the percentage of the user's share of the amount of liquidity including the tick in which the transaction occurred compared to the total amount of active liquidity including containing the tick at which the transaction occurred. (Pool usage fee distributed per transaction occurrence point)

Users will have a higher liquidity stake if they deposit the same amount of assets at a narrower price range.

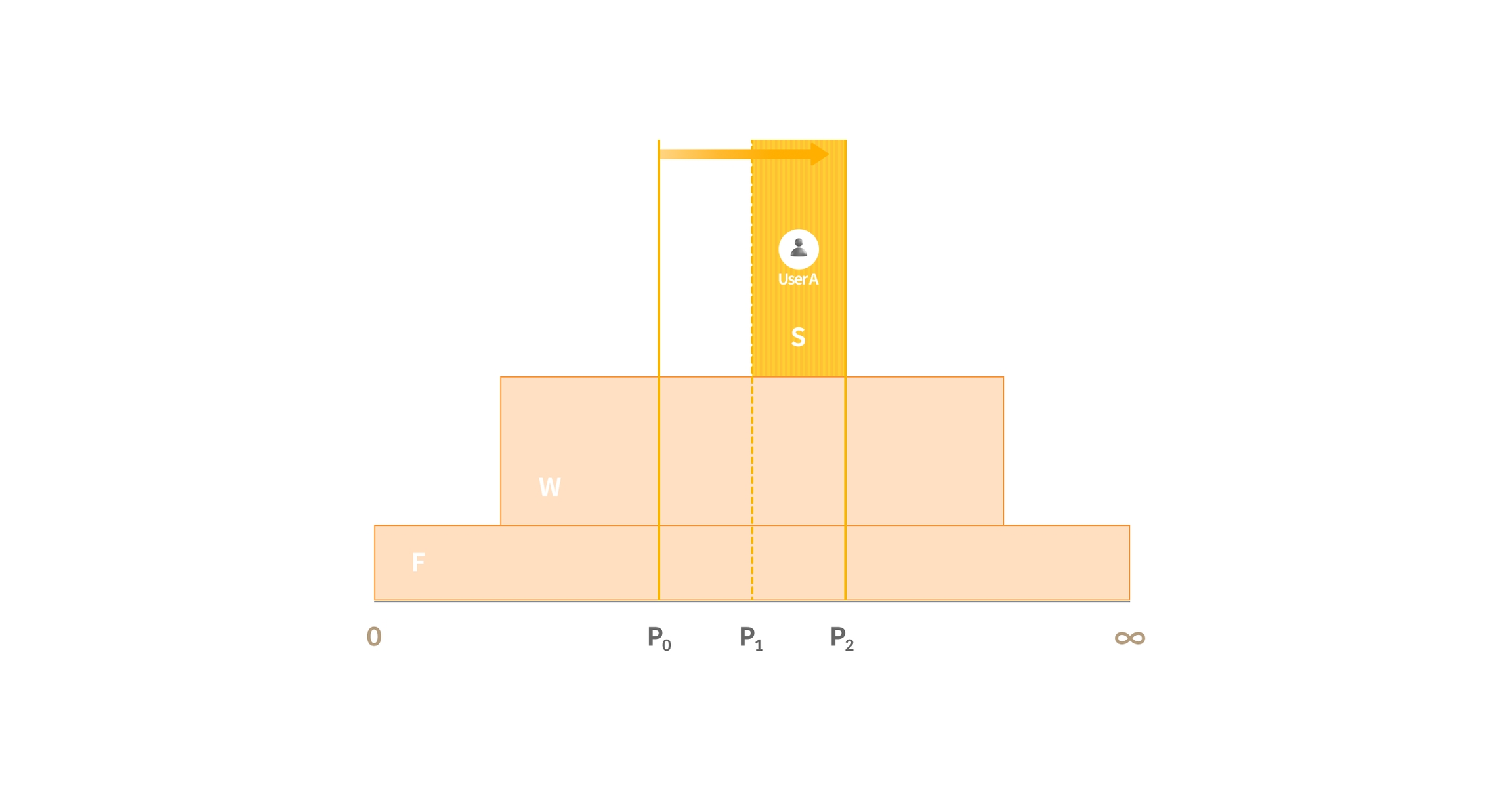

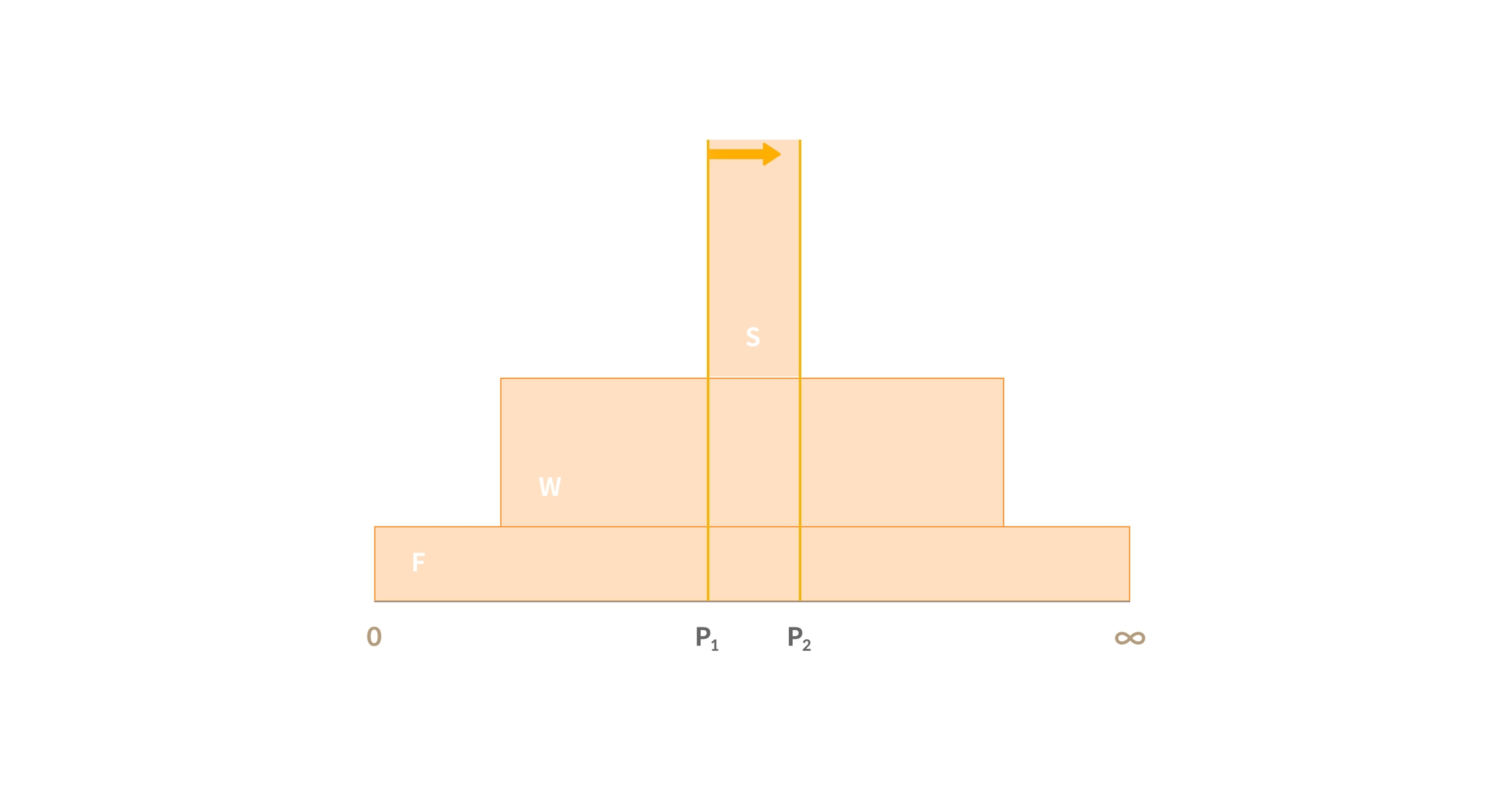

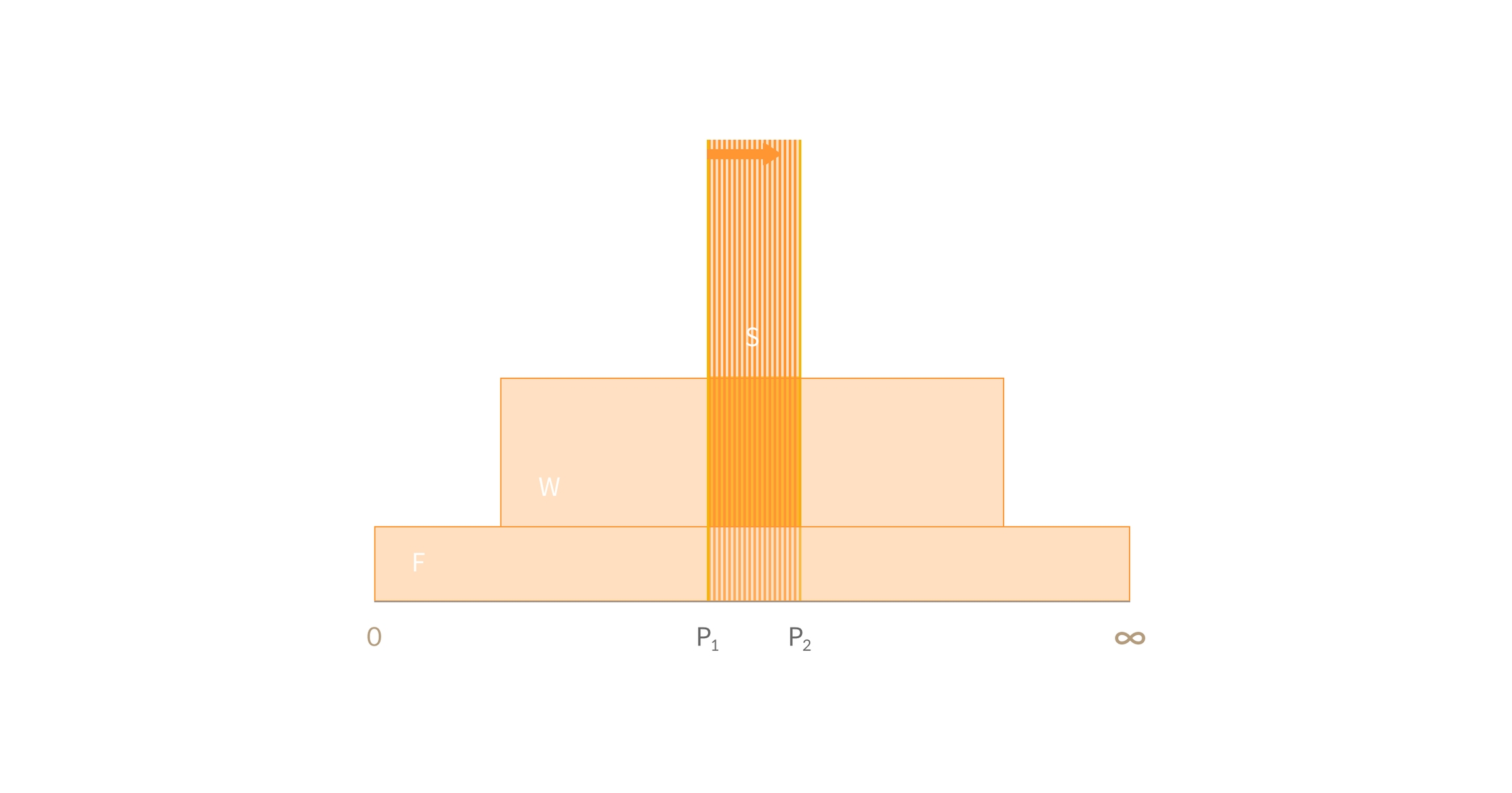

Let’s say a $1,000 asset is supplied in Full Range. In that case, as shown in Figure ①, the asset will be equally supplied in the entire price range (0~∞). However, when the asset is supplied in a narrower price range (Pa~Pb), as shown in Figures ② and ③, suppliers can enjoy the effect of higher liquidity supply even with the same amount of asset.

Assume that the assets are supplied into a USDT-DAI pool in only the three types of ranges mentioned above, the figure below shows their spread of liquidity.

If the token price changes from P0 to P2 due to a transaction within the pool, User A's assets will not be used in the P0 to P1 range. Instead, user A's liquidity will be used for trading in the P1 to P2 range. The share ratio of user A in the active trading liquidity in the P1 to P2 range is (user's liquidity (A)/activated liquidity (T).

Therefore, when the trading volume and scale of liquidity in the P1-P2 section is as follows, user A earns the following amount of fee:

USDT-DAI pool transaction fee rate: 0.06%

Swap Volume: $100

User A’s liquidity in the P1 to P2 range (A): $ 1,000

Total liquidity in the P1 to P2 range (B): $ 100,000

A’s pool usage fee profit = ($100*0.0006)*(1,000/100,000)= $0.0006

<Estimated Pool usage Fee Rate APR Calculation>

Calculated and displayed is the expected annual return when pool usage fees from a specific pair of V3 pools are distributed to currently active liquidity.

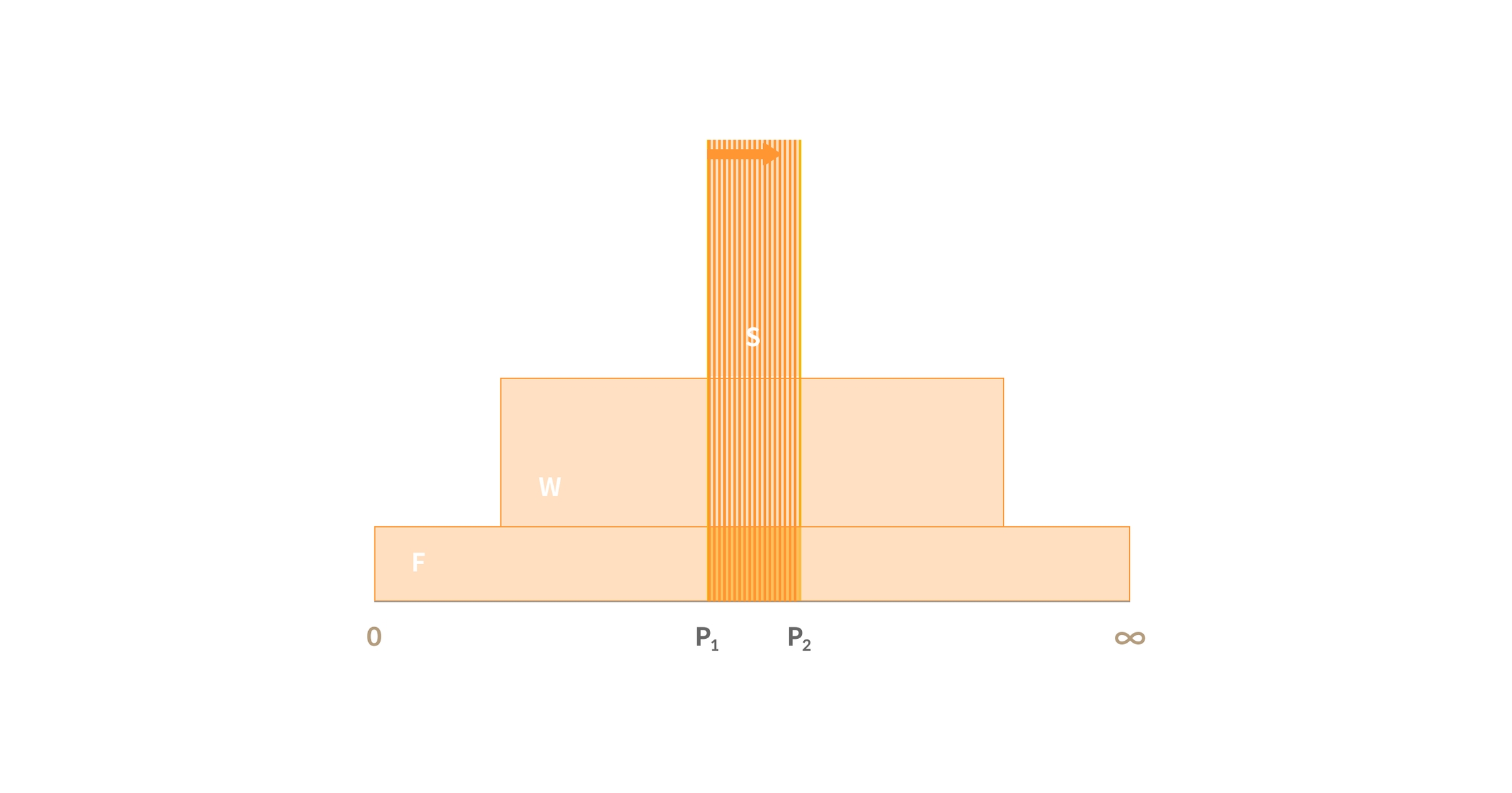

Suppose assets are supplied in USDT-DAI pools according to price range type (Spot, Wide, Full):

If token price is converted from P1 to P2, activated liquidity(T) in the pool is as follows:

Assuming the trade volume is between the P1 and P2 range and the liquidity size (Spot, Wide, Full range) of each price range is as follows, the expected return will be calculated as follows.

USDT-DAI Pool Fee Rate : 0.06%

Latest 24 Hour Volume: $1,000

Total liquidity of the USDT-DAI pool’s P1 to P2 range (T) : $ 100,000

Liquidity supplied when depositing in Spot range (S) : $ 27,000

Liquidity supplied when deposing in Wide range (W) : $ 4,650

Liquidity supplied when depositing in Full range (F) : $ 10

* Spot Estimated Transaction Fee APR

= Pool usa fee for the last 24 hours *(Activated Spot Liquidity (S)/ Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($27,000/$100,000)*100*365 = 5,913% annually

* Wide Estimated Transaction Fee APR

= Pool fee for the last 24 hours * (Activated Wide Liquidity(W)/Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($4,650/$100,000)*100*365 = 1,018% annually

* Full range Estimated Pool usage fee APR

= Pool fee for the last 24 hours * (Activated Full range Liquidity(F)/Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($10/$100,000)*100*365 = 2.19% annually

Calculated and displayed is the expected annual return when the daily airdrop token quantity distributed in the V3 pool is distributed in currently active liquidity. The airdrop return rate calculation is the same as the 4) KSP Reward APR.

* Spot/Wide/Full range type’s estimated air drop APR

= Daily token distribution quantity * Token price * (Each type of activated liquidity/Total Activated Liquidity)*100*365

Airdrop tokens are distributed in real-time (based on the block creation time of Silicon Chian) to the current active liquidity, so even if the assets were supplied within the active liquidity range the previous day, users might not receive rewards if the liquidity range isn't active at the time of distribution. Therefore, users must constantly check that their assets are within the active range. When the token price falls out of range (out of range state), the asset must be migrated or re-supplied after removing to earn rewards. Check out the migration guide.

function lockRewardToken(uint amount, uint lockPeriodRequested) publicevent UnlockRewardToken(address user, uint256 vRewardTokenAmount, uint256 rewardTokenAmount);event UnlockRewardTokenUnlimited(

address user,

uint256 vRewardTokenBefore,

uint256 vRewardTokenAfter,

uint256 rewardTokenAmount,

uint256 unlockTime

);event RefixBoosting(address user, uint lockPeriod, uint boostingAmount, uint unlockTime);event ChangeMiningRate(uint _mining);event GiveReward(address user, uint amount, uint lastIndex, uint rewardSum);event Compound(address user, uint reward, uint compoundAmount, uint transferAmount, uint mintAmount);

blockNumber : prior blockNumberindex : indexfunction getPriorBalance(address user, uint blockNumber) public view returns (uint) function snapShotBalance(address user, uint index) public view returns (uint) function unlockRewardToken() publicfunction unlockRewardTokenUnlimited() publicfunction refixBoosting(uint lockPeriodRequested)function claimReward() publicfunction compoundReward() publicCalled to msg.sender after executing a swap via IUniswapV3Pool#swap.

In the implementation you must pay the pool tokens owed for the swap. The caller of this method must be checked to be a UniswapV3Pool deployed by the canonical UniswapV3Factory. amount0Delta and amount1Delta can both be 0 if no tokens were swapped.

Parameters:

Swaps amountIn of one token for as much as possible of another token

Parameters:

Return Values:

Swaps amountIn of one token for as much as possible of another along the specified path

Parameters:

Return Values:

Swaps as little as possible of one token for amountOut of another token

Parameters:

Return Values:

Swaps as little as possible of one token for amountOut of another along the specified path (reversed)

Parameters:

Return Values:

struct ExactInputSingleParams {

address tokenIn;

address tokenOut;

uint24 fee;

address recipient;

uint256 deadline;

uint256 amountIn;

uint256 amountOutMinimum;

uint160 sqrtPriceLimitX96;

}struct ExactInputParams {

bytes path;

address recipient;

uint256 deadline;

uint256 amountIn;

uint256 amountOutMinimum;

}function uniswapV3SwapCallback(

int256 amount0Delta,

int256 amount1Delta,

bytes data

) externalstruct ExactOutputSingleParams {

address tokenIn;

address tokenOut;

uint24 fee;

address recipient;

uint256 deadline;

uint256 amountOut;

uint256 amountInMaximum;

uint160 sqrtPriceLimitX96;

}struct ExactOutputParams {

bytes path;

address recipient;

uint256 deadline;

uint256 amountOut;

uint256 amountInMaximum;

}amount0Delta

int256

The amount of token0 that was sent (negative) or must be received (positive) by the pool by the end of the swap. If positive, the callback must send that amount of token0 to the pool.

amount1Delta

int256

The amount of token1 that was sent (negative) or must be received (positive) by the pool by the end of the swap. If positive, the callback must send that amount of token1 to the pool.

data

bytes

Any data passed through by the caller via the IUniswapV3PoolActions#swap call

params

struct ISwapRouter.ExactInputSingleParams

The parameters necessary for the swap, encoded as ExactInputSingleParams in calldata

amountOut

uint256

The amount of the received token

params